What a horrible thing to say! We here at Megaphone Journal certainly aren't saying it. But it's been said. It's there.

Commonwealth Bank are unrepentant wage thieves.

...is the thing that has been said. In other places.

Here it is again:

�Commonwealth Bank are unrepentant wage thieves�

This past week the Commonwealth Bank called the Finance Sector Union "reprehensible" for making claims such as the one above ("unrepentant wage thieves" - you remember). And it's about to get a whole lot uglier.

The bank is currently seeking to bypass the union and secure a non-union EBA which would retroactively legitimise their behaviour, but this is the pointy end of a long saga dating back over ten years.

Last year there were many stories detailing the rampant wage theft CBA were found, definitively, to have committed. The sum total of the money they subsequently had to pay back was $53 million, affecting around 41,000 current and former staff. We often hear stories about wage theft taking the form of cash payments in less-than-professional operations and small businesses, but to steal $53 million you need infrastructure. You need a system to do it. So how did it happen?

A common practice at the Commonwealth Bank has been to make use of Individual Flexibility Arrangements, or IAs. These are allowed by their EBA, under certain conditions. The three chief conditions are that a) they must be genuinely agreed upon by both parties, b) they can't be part of an offer of employment, and c) they must be reviewed each year to ensure that the arrangement leaves the worker better off overall than if they were not on such an agreement. On paper, sounds fine. Except there ended up being over fifteen thousand of them, and they came to be massively exploited and led to rampant systemic problems.

They were barely ever genuinely agreed upon, they were presented to new starters as their "contracts" and they were literally never reviewed by management. So while an individual's "contract" might have been better off than the conditions in the EBA to start with this, they were rapidly left in the dust behind where they should have been. Perhaps worst of all, the yardstick that the individual arrangements were required to compare to was the very base set of conditions in the EBA, not any of the higher levels that staff might expect. So when they were supposedly compensating people for forgoing certain entitlements in the EBA, like RDOs for example, they were buying them out at a much lower rate than if they had done so properly.

This all sounds very complicated, but the simple version is that CBA used the instruments in their EBA to effectively erode the EBA and create individual agreements by stealth.

The bank claims oversight, rather than deliberate wage theft, but this isn't a corner shop paying a flat rate cash-in-hand. The setting up of the systems that led to the shortfall of wages for so long was very much a calculation by the bank and its management. The deliberate chaos of thousands of individual contracts could have been simplified with a clear and robust EBA, and the bank would never have tied itself in knots the way it did. Their anti-union stance ultimately became their own downfall.

�CBA used the instruments in their EBA to effectively erode the EBA and create individual agreements by stealth.�

So how to proceed from there? The bank came with its hat in its hand to the union and said, mea culpa, we want to talk about a new EBA to replace the old one that had just been rolling over since 2017. They wanted to avoid more scandals, especially considering the whole money laundering thing that was also making headlines. Great. Progress. Except the problem was that the EBA the bank proposed was just a simplified and codified version of the practices it had been engaging in for the past decade.

The word "unrepentant" comes to mind. Again. Unrepentant wage thieves.

CBA didn't, and still don't, want to fix the problems they created. They just want workers to agree to them so they can continue doing what they have been doing. This week they are going to ask workers to vote yes on a proposed agreement where they have removed the entitlements they were supposedly buying out in their individual agreements, and offering a pay rise that is smaller than the entitlements they intend to cut. Essentially, they want to do to the entire workforce in one fell swoop what they had been doing to individuals one-by-one for over a decade. And if they're successful, it won't be illegal anymore.

Still confused? Great. Welcome to CBA. Don't sign anything.

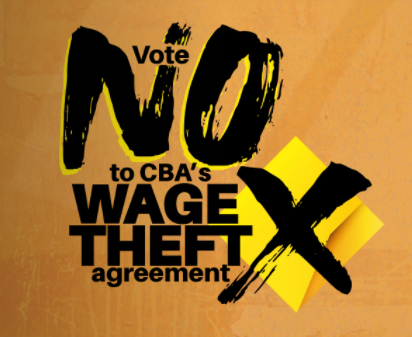

The vote is taking place this week. Management are sending countless emails encouraging staff to accept the proposal, while the union is running its own campaign for a no vote. It will be close, precisely because of how confusing all these issues are. The FSU have been making short, clear explainer videos and laying it out as simply as possible, but there is a lot to unpack. On the other hand, "vote yes for a pay rise" is quite simple.

No one is willing to predict the outcome, but a deal with a pay rise was rejected in October last year, suggesting it isn't the only thing on workers' and especially union members' minds. In the meantime, if you're a Commonwealth Bank customer you can drop by your local branch and have a chat with the staff there. Go to the resources page on their website and pull whatever you need to go and make sure they know just how important it is that they VOTE NO.

Or you can also contact the CBA on social media and remind them that they are, in fact, UNREPENTANT WAGE THIEVES.